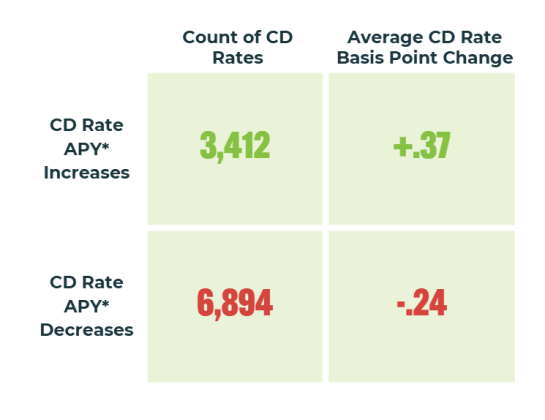

CD Rate Movements in Q1 2025

Overall, CD rates went up in Q1 2025

Despite the federal funds rate remaining unchanged after the FOMC meetings in January and March 2025, CD Valet data shows that 1 in 3 CD rate changes was a positive one.

This indicates that while many financial institutions are adjusting their CD rates downward, there are still opportunities for consumers to secure attractive CD rates. With a significant number of rate increases (25% more increases compared to Q4 2024), consumers can still find competitive options to maximize their savings.

Visit www.cdvalet.com to view CD rates today.

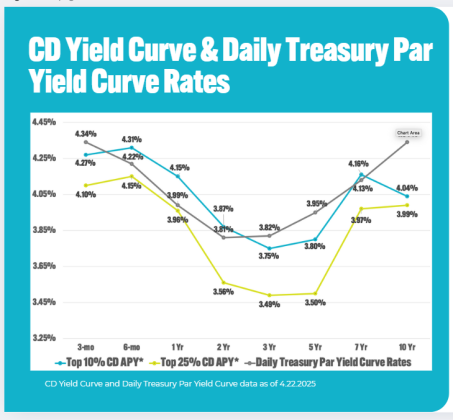

CD Yield Curve Analysis

This graph highlights the comparative performance of CDs and Treasury yields over different term durations, with short-term CDs being more favorable, a mid-term dip across both products and long-term convergence.

The general rule is that interest-bearing investments of the same term should pay higher yields than Treasuries and this is not consistently the case today. CD rates are lower at the maturities greater than one year because the economic and political uncertainties today mean that financial institutions don’t have a high level of confidence in what direction rates are headed. Financial institutions, which as a business are much more sensitive to interest rate changes than other companies, have to carefully navigate how they price deposits to manage that risk. The uneven gap between the Top 25 percent and the Top 10 percent of CD yields across terms further illustrates the uncertainty in the market.

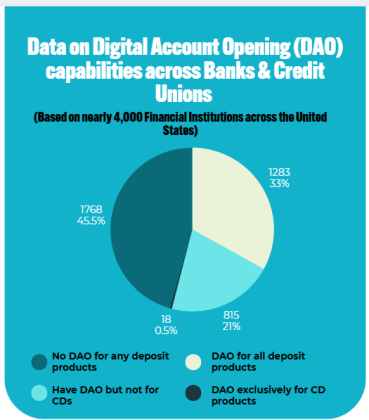

Nearly 50% of Financial Institutions have no digital account opening for deposits

In today’s digital age, consumers expect convenience and efficiency when managing their finances. However, only 1 in 3 financial institutions offer digital account opening (DAO) for all deposit products.

The research conducted by CD Valet displays that the prevalence of DAO among financial institutions varies, with a significant portion still lacking this capability. However, for those who have implemented DAO, the benefits are clear. This solution not only increases conversion rates for digital marketing efforts but also enhances the overall customer experience, making it a critical component of successful online marketing and deposit acquisition strategies.

Survey conducted in March 2025

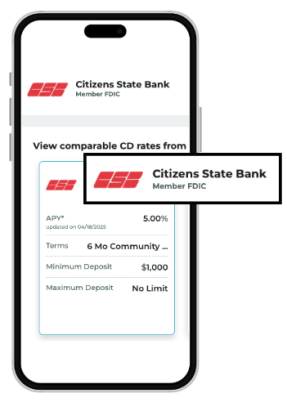

Ratewatcher Sighting: The CD for Pet Lovers

Open a 6-Month community building Certificate of Deposit (CD) with a base APY of 5.00% and a minimum deposit of $1,000 from Citizen State Bank, Member FDIC.

Savers can help support Coco’s Heart Dog Rescue with this CD. The interest earned on the CD will be donated to the charity within 30 days of maturity.

Methodology

**CD Valet provides rates for an ever-growing number of financial institutions. A financial institution must post CD rates on its public website to be included. All financial institutions that publicly post their CD rates and have more than $250 million in total assets are automatically listed. Financial institutions under $250 million in total assets may be included if they offer competitive and publicly available rates. CD Valet includes many of the largest financial institutions and online financial institutions with a presence across the nation.