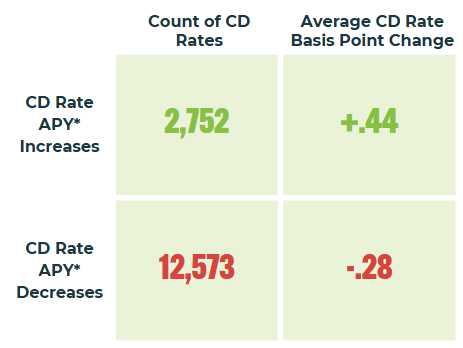

CD Rate Movements in Q4 2024

Despite Fed Rate Movement in Q4, CD rate increases still occurred

When they go low, we go high. That’s how some financial institutions react to Federal Reserve rate changes. When the benchmark rate fell in Q4, CD Valet data showed that some banks and credit unions hike rates as they readjust pricing in response to competitive or funding needs. Nearly 1 in 5 CD rate movements in Q4 were positive, reflecting an average increase of 44 basis points. This is evidence of why it pays to always shop before opening a CD, ensuring you can find the best rate to meet your needs. Visit cdvalet.com to view CD rates today.

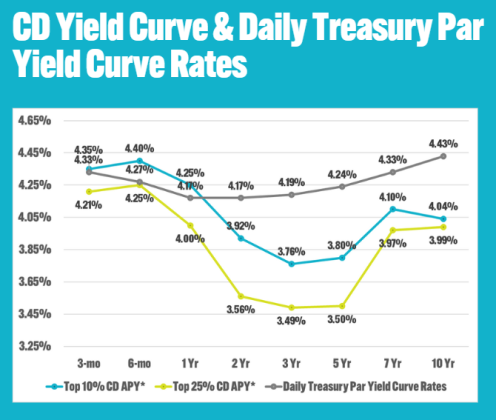

Current CD Valet Yield Curve or the big dipper?

Currently, short-term CDs still offer the highest APYs amongst CD products – specifically those under 1 year. Comparing the yields of top-paying CDs across maturities to the Treasury yield curve, we can see that when it comes to flattening, the yield curve for CDs has not yet caught up. Our Ratewatchers are finding more long-term CDs with attractive rates, but the CD yield curve has a way to go before it returns to “normal.”

Check in on 2025 Ratewatcher Reports to observe and learn more about changes to the CD Valet Yield Curve.

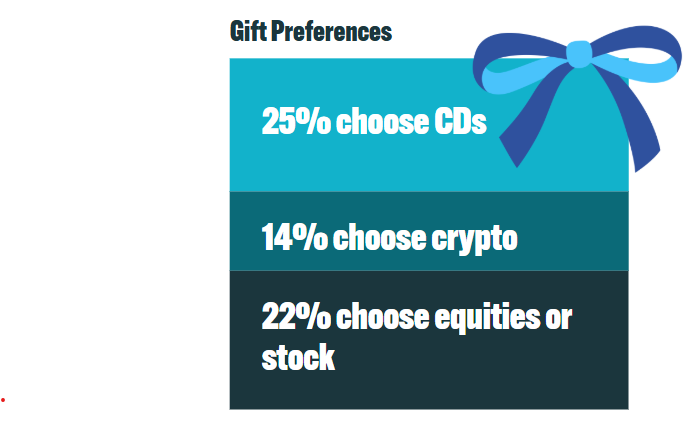

Have you ever gifted a Certificate of Deposit?

Based on a survey conducted by YouGov, 25% of participants highlighted Certificates of Deposit (CDs) as a preferred investment gift.

CDs are particularly appealing due to their low risk and predictable returns, making them an excellent choice for securing the financial future of children and grandchildren.

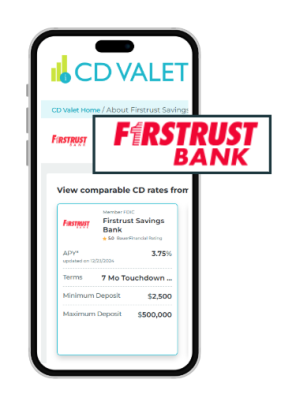

Ratewatcher Sighting: Touchdown CD

Savers in Pennsylvania, New Jersey, and Delaware may see their rate increase, based on how many points Philadelphia scores during Sunday’s big game. With this CD, savers have the opportunity to add extra basis points to their CD rate for their final APY*. (CD must be opened before 2/8/25 at 4pm EST).

Methodology

**CD Valet provides rates for an ever-growing number of financial institutions. A financial institution must post CD rates on its public website to be included. All financial institutions that publicly post their CD rates and have more than $250 million in total assets are automatically listed. Financial institutions under $250 million in total assets may be included if they offer competitive and publicly available rates. CD Valet includes many of the largest financial institutions and online financial institutions with a presence across the nation.